Why Theory A?

Published: July 7, 2022

While we have a post detailing the basics of value factor investing and how to use our platform, this post will dive into the philosophy behind the Theory A platform and what makes it unique.

Theory A started off as an attempt to solve these two problems:

- How to create a "bicycle for the mind" to empower investors.

- How to avoid "Meme Stock Momentum".

A Bicycle for the (Investing) Mind

Steve Jobs once told a story about how as a child he read an article that measured the efficiency of locomotion for various species. E.g. how many calories they expended to get from A to B.

The condor came in at the top while the human was somewhere in the middle.

However the human riding a bicycle blew away even the condor.

And it made a really big impression on me that we humans are tool builders and we can fashion tools that amplify these inherent abilities that we have to spectacular magnitudes and so for me a computer has always been a bicycle of the mind, something that takes us far beyond our inherent abilities.

The computer as bicycle didn't just create a new faster way of walking, it created an entirely new way of thinking and working. Reducing friction isn't just a nice-to-have just as a computer is not just a fast calculator.

Each increase in efficiency unlocks entirely new behaviors.

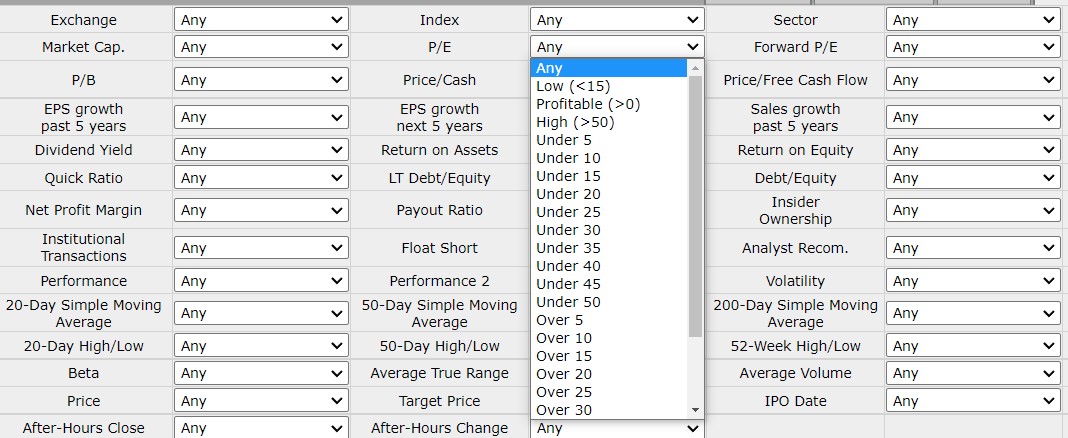

With investing, screeners that ask you fill out dozens of dropdowns before you can see anything are particularly frustrating. As Bret Victor, a former apple engineer says, these UI's cause the user to "beg the graphic for every scrap of information" and force the user to "interact constantly".

More time is spent adjusting the parameters of the tool rather than using the tool for its intended purpose.

Which one of these dropdowns is useful for what I'm looking for? Is a P/E ratio of 30 good or bad? What about 10? Not only do you have to know what each dropdown does but you have to memorize heuristics for each one. Heuristics that can quickly become outdated as the macro environment changes.

The essence of data graphics is visual comparisons. An excellent graphic offers its information generously and eagerly, encouraging the reader to answer wide-ranging comparative questions at a glance. An excellent interactive graphic offers opportunities to explore the data space more precisely, to slice and filter the data, to see the data from specific perspectives. Interactivity should not be used as a barrier to information.

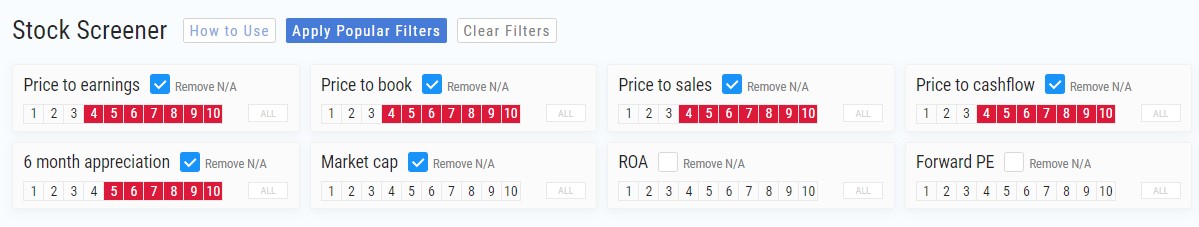

Contrast the above screener to our screener below:

Each piece of data occurs with its context. It's obvious to see which P/E ratios are high relative to others and which ones are low. Rather than have make a guess based on the raw number you can visually see how each stock's value compares to the rest. Often times the relative value is more important than the raw value.

The dropdowns in Theory A are also designed to empower the investor.

Instead of dropdowns with different sets of values in each, every option in Theory A is normalized based on deciles. Every interactive element is designed to be informational. This allows the user to slice the data in powerful ways.

Each click updates the table dynamically. This make the interactions meaningful and worthwhile rather than a chore. Every click is rewarded with new information.

Traditional screeners meanwhile expect you to know exactly what you are looking for and click through dozens of dropdowns specifying exact values for each before you get any feedback.

Compared with traditional ways of screening and visualizing data, Theory A is much better at helping you explore and get a feel for the data.

Meme Stock Momentum

One of the benefits of a bicycle is that it makes previously unaccessible parts of your neighborhood accessible. Similarly, Theory A aims to make value investing more accessible.

While value investing is sometimes thought of as the default boring path to investing, most retail investors actually default to meme investing.

This is true even if the investor dislikes risk.

There are multiple reasons for this but the primary one is a tendency to invest in the familiar and this tends to be whatever is circulating in our information bubbles.

In others words, viral meme stocks that are by definition "viral" and everywhere take up far more space in our minds than we might like.

Even if we consider ourselves contrarian investors that think for ourselves, we have a basic need for social acceptance and buying recognizable meme stocks that everyone is talking about is a safe way of being part of the group.

Even if everyone is wrong, at least everyone is wrong together. And since excess wealth is primarily used for status, being wrong together ensures that no one loses status relative to each other.

Combined, these properties make meme stock investing feel very safe and easy despite being the most volatile assets out there. They are safe from a social perspective, but not from an economic perspective.

In order to make value investing more accessible, Theory A aims to create tools that allow investors to think for themselves instead of wrestling with frustrating data.

It allows us to see that the essence of value investing is not buying boring stocks or copying Warren Buffet but thinking for ourselves and deciding on our own what is valuable and what is not.

It allows us to leverage the wisdom of crowds as a tool, not as a crutch.

For more on what we do, follow us on Twitter